Blog > Your October 2025 Market Report

Your October 2025 Market Report

Check out October's real estate stats!

What Went Down in October

Market Overview

Austin closed out October with 677 single-family home sales, reflecting a 5.8% increase from the previous year. The Median Sales Price for the month settled at $584,900, marking a negligible 0.4% year-over-year increase. Meanwhile, the Average Sales Price saw a substantial 4.3% increase year-over-year, climbing to $838,942.

Price per square foot averaged $350, nearly matching the year-ago figure. The average days on market were at 68 days, down from the previous year, and the median days were at 48, down 5.

This segmented market—where a competitive sale price is paramount—requires sellers to price with precision and market with intent to capture buyer attention.

Months Supply Of Inventory

New listings in October totaled 1,032, showing a 17.5% increase from the previous year. Meanwhile, New Under Contracts (demand) reached 722, an increase of 13.7% from last October.

The increasing flow of new inventory relative to contracted properties reinforces a market where buyers have abundant choice.

The Months Supply of Inventory (MSI) for single-family homes in the City of Austin is 4.4 months as of November 10, 2025. This is firmly below the six-month threshold that defines a perfectly balanced market, technically keeping the area in a Seller's Market territory. However, when viewed in the context of increasing inventory and escalating days on market, the leverage is clearly in the buyer's favor.

Price Cuts & Compression

Price reductions are now a fundamental part of the negotiation cycle. In the month of October, listings that reduced their price went under contract after a median of 24 days. This underscores a key market dynamic: homes must meet the market to move.

- The median time a listing remains on the market before a price cut occurs is 20 days.

- The average price reduction across all active listings is 9%.

List-to-Close & Buyer Leverage

Homes closed at an average of 91.99% of their original list price in October. This metric, coupled with widespread price cuts, signals a continued shift in negotiating power. Buyer leverage is significant—they can negotiate on price, repairs, and closing costs, especially for homes that are "sitting" on the market. For sellers, overpricing is the quickest way to garner lower offers; presentation, flexibility, and sharp pricing are now essential for a successful outcome.

90-Day Trend

The market over the past three months shows a clear downward pressure on pricing, followed by signs that strategic price adjustments are beginning to align with buyer expectations, resulting in faster sales.

Median Sale Price: The Summer Peak Fades moving into the fall and winter season.

Median Sale Prices experienced a swift decline following the summer highs, emphasizing the necessity of sharp pricing in this buyer-centric market.

- August 2025: Peaked at $645,000

- September 2025: Dropped significantly to $590,000

- October 2025: Settled at $584,900

What’s Coming Next (60-Day Outlook)

Buyer-friendly conditions are expected to persist into the deep fall and early winter monthThe key dynamics of high inventory and price resistance will continue to shape the market.

Sustained Price Sensitivity: The Median Sale Price saw a rapid drop from the summer peak in August ($645,000) to October ($584,900), demonstrating the market's sensitivity to price. Sellers entering the market in November and December will need to price sharply from day one to avoid lengthy Median Days on Market (DOM) periods, which rose to 53 days in September before falling to 48 days in October.- The Power of the Pivot: With listings that reduce their price going under contract after a median of 24 days, the market rewards decisive action. We anticipate a continued high rate of price reductions throughout the next two months as sellers who initially over-priced adjust their strategy.

- The January Foreshadow: A considerable amount of "backlogged inventory"—homes that were listed, did not sell, were leased temporarily, and are now waiting to re-list—is expected to hit in January, leading to a crowded "new spring market" beginning earlier than usual.

Sellers should view the next 60 days as a critical, less-crowded window to secure a sale before this new wave arrives.

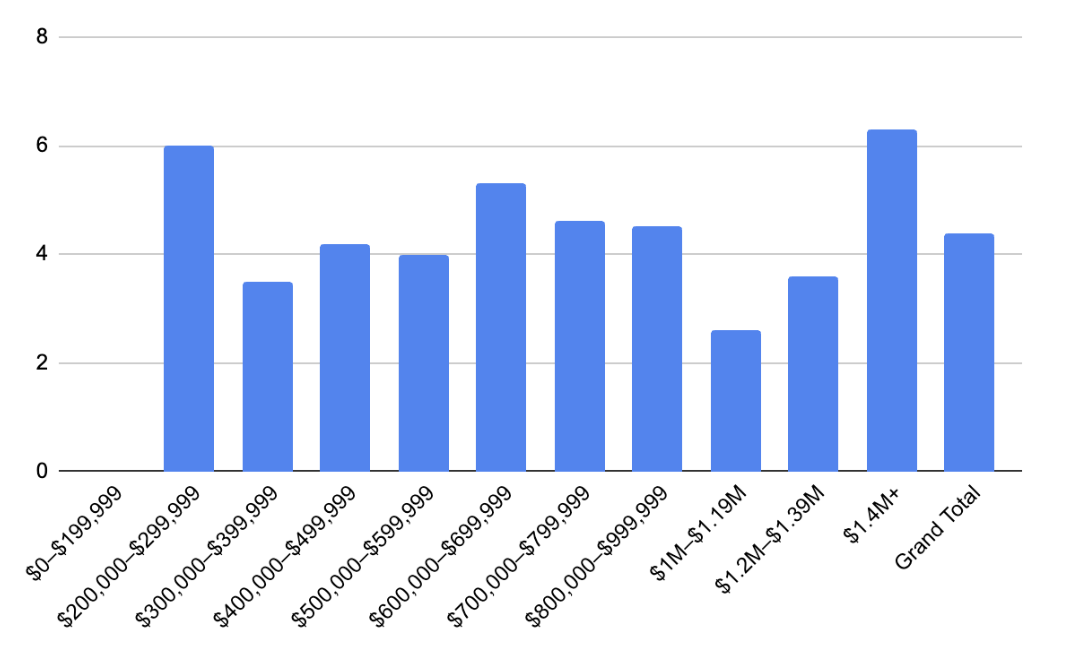

Months Of Supply By Price Point

The single-family market currently displays clear segmentation by price range, even as the overall Months Supply of Inventory remains in "Seller's Market" territory at 4.4 months, some segments are clearly favoring buyers.

- Tightest Inventory (Strongest Seller's Market): The most constrained segment is the nascent luxury tier, with the $1M–$1.19M range showing the lowest supply at only 2.6 months.

- The $300,000–$399,999 bracket is also tight at 3.5 months.

- Balanced to Buyer's Market: Buyer leverage is maximized in the top-tier luxury market. The $1.4M+ price range is the only segment officially in a buyer's market, with 6.3 months of supply.

- Mid-Range Stability: The broader middle market, spanning from $400,000 up to $999,999, shows consistent supply hovering between 4.0 and 5.3 months reinforcing a climate where properties must be sharply priced to avoid buyer resistance.

Average Days on Market Sold Price to Original List Price %

The Average DOM shows the number of days a property was on the market before it sold.

An upward trend in DOM indicates a move toward a Buyer’s market.

The Sold Price vs. Original List Price reveals the percentage of the Original List Price properties sold for.

Monthly Supply of Inventory

Real estate economists tell us a six-month supply of For Sale Inventory represents a balanced market between sellers and buyers.

Over six months of For Sale inventory indicates a Buyer’s market. Less than six months of inventory indicates a Seller’s market.

New Listing Taken | New Under Contracts

Thanks for reading!

Ready to achieve your next real estate goal?

Please reach out to chat.